Equifax Ratings Services - June 2024 - Construction industry participants, nowadays, are more wary of difficult trading conditions and are taking notice of the numerous business failures; ASIC’s insolvency data for the nine-month period from 1 July 2023 to 31 March 2024 show that 2,142 construction companies entered into external administration (accounting for 27.7% of the total number of business failures for that period). Subsequently, companies are being more cautious and are more likely to undertake relevant financial assessments.

With Equifax’s robust credit rating methodology and processes, and the qualifications and expertise of its analyst team, we are able to identify early warning signals of company failures and their potential impacts. As a result, we are able to recommend appropriate risk mitigation measures to our clients for contracts with counterparties. The cases below highlight the importance of an in-depth analysis of non-systemic risks and factors that may be impacting various aspects of an individual business, qualitative and quantitative assessment of industry risk factors and current macroeconomic environment, and the ability to connect the dots that otherwise may go unnoticed.

Allroads Pty Ltd

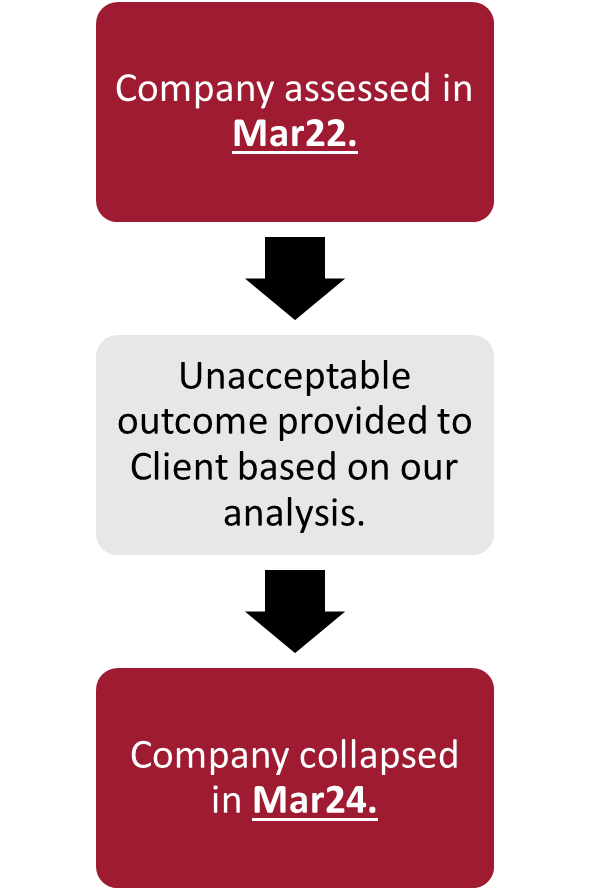

At the end of FY22, AllRoads Pty Ltd (‘Allroads’) had $28.0m in assets and $19.5m in total liabilities, translating to a healthy equity position of $8.5m. The Equifax Credit Ratings team undertook an assessment in March 2022, and opined that Allroads was an unacceptable counterparty risk.

Our in-depth analysis identified that one of the biggest risks with Allroads was that most of its capital was tied up in loans receivable from directors/related entities within a complex group structure. Since all internal capital was leaked to directors, the company essentially relied on external sources of capital to fund its operations. This created unsustainable pressure to keep activity levels growing in light of the company’s poor profitability.

Moreover, we highlighted that in FY20 and FY21, Allroads was able to sustain operations only because it received COVID support payments from the government, without which it would have reported losses.

Though the company had multiple projects with low counterparty risk clients, its weakening operating and financial profile was increasing the likelihood of failure in our view. Hence, we outlined the trend in the company’s credit profile as moving from acceptable but high-risk level to very-high risk and unacceptable for the proposed contract to our client.

We noted Allroads was awarded several large-scale projects within the preceding few years, including a $50.0m project for an Australian Defence Force base in Central Queensland, a $35.0m project for RAAF barracks in Townsville and a $92.0m contract to build a metro depot in Brisbane’s CBD.* These projects were severely impacted by Allroads’ failure in March 2024; pre-contract award due diligence could have advised the principals of the risks associated with the company and enabled appropriate risk mitigation measures.

Rork Projects Pty Ltd

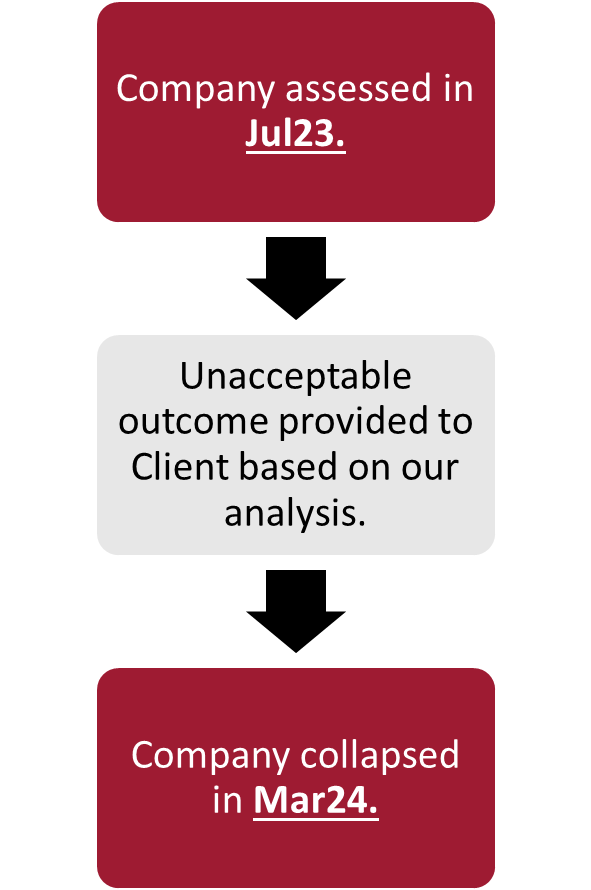

The Equifax Credit Ratings team undertook an assessment on Rork Projects Pty Ltd (‘Rork’) in July 2023 and opined that the company was an unacceptable counterparty risk.

We noted Rork’s revenue and profitability had been impacted for successive years due to multiple loss-making contracts. Since these contracts were not yet complete, our opinion was that the company was still exposed to mounting pressures from the rising costs of inputs as well as material/labour shortages.

A bigger concern we highlighted was that despite the weak operating performance and depleted cash reserves, Rork continued to lend, and not collect back, material amounts to related entities. Resultantly, Rork’s reliance on its external borrowings was elevated, leaving negligible available headroom to fund its operations. Coincidence of losses on projects and the rising interest rate environment at the time hampered Rork’s ability to service its outstanding debt obligations. We noted, apart from a high reliance on bank borrowings, the company’s growing dependence on support from its creditors and clients through trade creditor accruals and revenues in advance respectively, was a sign of further distress.

Rork Projects (Holdings) Pty Ltd, Rork Projects (QLD) Pty Ltd and Rork Projects Pty Ltd (which made up the Rork Group) filed for external administration in March 2024. At the time, the Rork Group had 63 active projects across QLD, NSW, VIC and ACT. An average of $0.5m was owed to each of its suppliers and in the prior six months, Rork itself had three payment defaults lodged against it for failure to pay, of which a $0.2m debt had been settled; however, two other debts, for $62k and $40k, remained unpaid.*

Disclaimer

The observations noted above are solely statements of opinion and not statements of fact or recommendations to purchase, hold, or sell any securities or make any other investment decisions i.e. it does not constitute financial advice of any kind.

* Information derived from public sources:

1. news.com.au

2. theurbandeveloper.com

Login

Login